In 2025, real estate continues to stand out as one of the smartest long-term investment options. Unlike volatile markets like cryptocurrency or stocks, real estate offers stability, steady growth, and tangible benefits. Whether you're a first-time buyer or an experienced investor, property offers both wealth-building and peace of mind.

In this blog post, we'll explore the many reasons why buying real estate is still the best long-term investment. From appreciation and passive income to tax benefits and inflation protection, real estate delivers unmatched value.

Why Real Estate Is a Smart Long-Term Investment

Real Estate Appreciates Over Time

One of the most attractive features of real estate is appreciation. Property values generally increase year over year. Even with occasional dips, the overall trend is upward. This means your home or investment property is likely to be worth more in 10 or 20 years than it is today.

Example: A home purchased for $250,000 ten years ago could now be worth $400,000 or more, depending on the market.

Generate Passive Income with Rental Properties

Real estate can provide monthly passive income when rented out. Whether it’s a single-family home, duplex, or apartment complex, rental properties generate steady cash flow.

Tip: Look for locations with high rental demand to maximize returns.

- John Smith

Real Estate Is a Tangible Asset

Unlike digital or paper investments, real estate is physical. You can live in it, improve it, or rent it out. This makes it easier to understand and manage than other investment types.

It Offers Tax Advantages

Real estate offers many tax benefits, such as:

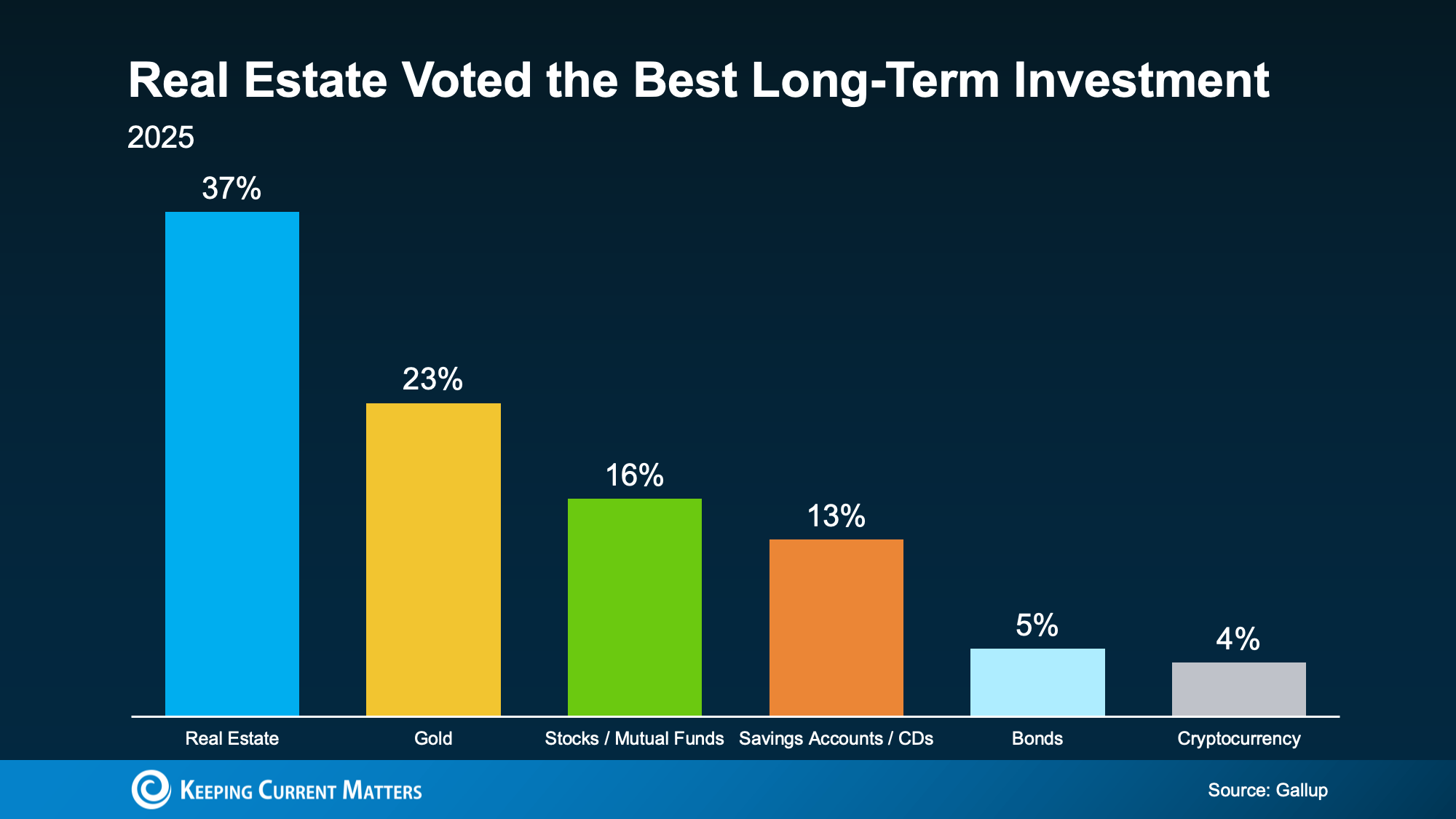

Real Estate vs. Other Investments

Real Estate vs. Stocks

While stocks can deliver fast gains, they are also highly volatile. Real estate is more stable and less affected by daily market swings.

Real Estate vs. Cryptocurrency

Crypto is exciting, but it’s unpredictable. Real estate offers slow, steady growth with far less risk.

Real Estate vs. Gold

Gold protects against inflation, but it doesn’t provide income. Real estate gives you both asset growth and rental income.

The Power of Leverage in Real Estate

One of the unique advantages of real estate is leverage. You can use borrowed money (like a mortgage) to buy a property, allowing you to control a larger asset with less of your own money.

Example: With a 20% down payment on a $300,000 house, you only invest $60,000 but gain equity on the entire $300,000 value.

This amplifies your ROI significantly over time.

Real Estate as a Hedge Against Inflation

When inflation rises, so do home prices and rental rates. Real estate acts as a natural inflation hedge, helping you maintain your buying power. As living costs increase, so does the value and income potential of your property.

Control and Customization

Real estate gives you more control than most investments. You can:

This hands-on approach allows you to actively grow your investment.

Portfolio Diversification and Risk Reduction

Adding real estate to your portfolio helps spread your risk. When stocks go down, property values may hold steady or even rise. Diversification makes your overall investment strategy stronger and safer.

Building Generational Wealth

Real estate can be passed down to your children or loved ones, creating lasting generational wealth. It’s an asset that can offer financial security for years to come.

Best Types of Real Estate for Long-Term Investment

Residential Properties

Commercial Properties

Land Investments

Tips for New Real Estate Investors

Do your research

– Understand local markets and future growth areas.Get pre-approved for financing

– Know your budget before shopping.Work with a real estate agent

– Especially one familiar with investment properties.Start small

– Consider a duplex or single-family rental to begin.Plan for the long term

– Real estate rewards patience and vision.Conclusion: Real Estate Is Still the Best Bet for Long-Term Wealth

In a world filled with complex investment options, real estate remains simple, stable, and smart. It’s a tangible asset that appreciates, generates income, and helps build lasting wealth. Whether you're buying your first home or expanding a property portfolio, real estate offers unmatched long-term value.

Ready to start your real estate journey?

Contact our experienced real estate team today for a personalized consultation and discover the best investment opportunities near you!